Barclays Alternative Risk Premia Select 4% RC Index

“All weather” strategy designed for the uncertain market conditions

Index Overview

Barclays Alternative Risk Premia Select 4% RC Index is a cross-asset, multi-strategy Alternative Risk Premia (ARP) portfolio designed as a balanced portfolio with defensive tilt. Barclays has designed the Barclays ARP Select 4% Index for fast changing market condition.

Key Features

Leverage on Barclays’ capabilities

Long standing quantitative investment strategies expertise from Barclays Investment Bank.

Access to Alternative Investment with time-tested strategies

Use of Alternative Risk Premia strategies to go beyond traditional stock/bond portfolio, with low correlation to equity and bond.

A balanced portfolio, with a defensive tilt

This index construction has historically shown steady performance with lower drawdown.

Robust Risk Management

Allocation based on equal risk contribution, together with 4% volatility control.

Investment Universe

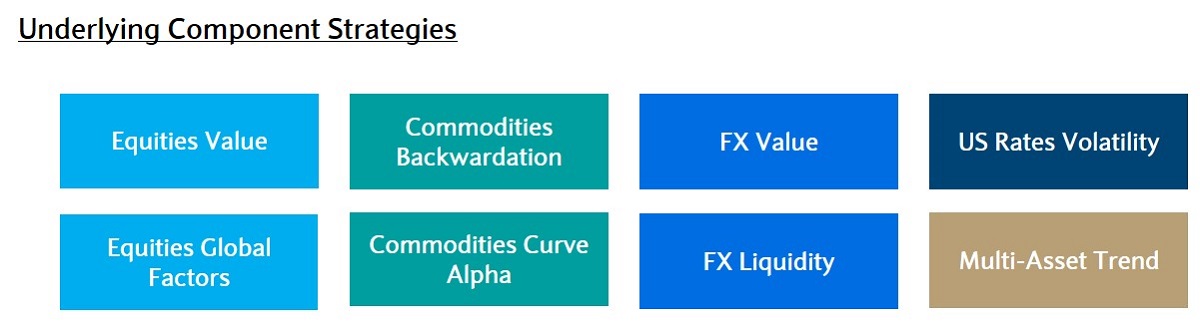

The Barclays ARP Select 4% RC Index consists of 8 component strategies, combining all risk-on, balanced, and risk-off strategies.

The index combines all 8 component strategies in order to achieve diversification, this means risk can be spread across different asset classes.

Please refer to “Component Strategies” section below for details on the 8 component strategies.

Source: Barclays. For illustrative purposes only.

Investment Process

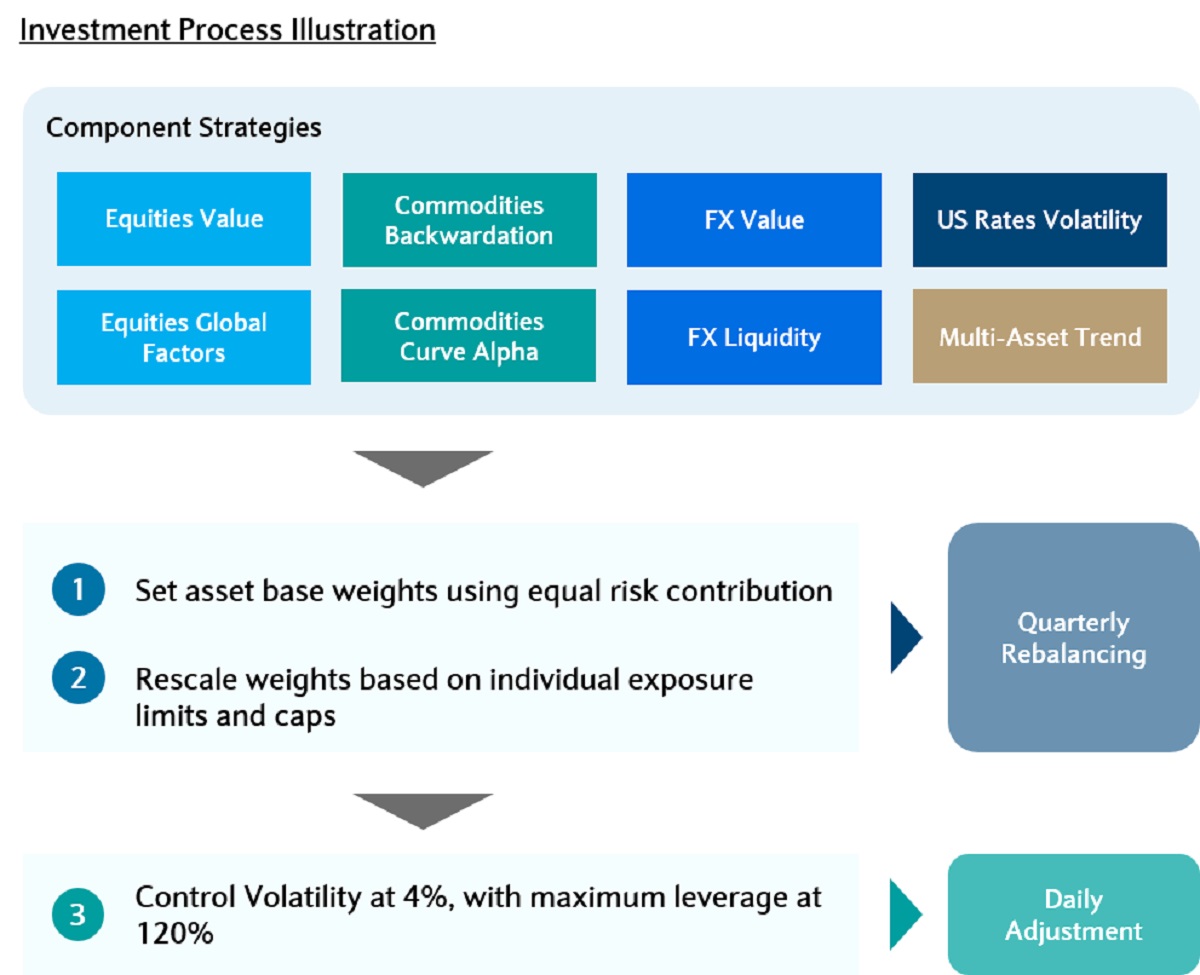

Barclays Alternative Risk Premia Select 4% RC Index employs a 3-step approach to allocate across component strategies based on changing market conditions.

Source: Barclays. For illustrative purposes only.

Component Strategies

|

Asset Class |

Risk Premia Source |

Description |

|---|---|---|

|

Equities |

Global Factors |

Market neutral investment in strategies providing exposure to Value, Momentum, Quality and Low Volatility equity factors in US, Eurozone, UK and Japan. The strategy combines 16 Barclays Equity Factor Market Hedged Indices, with quarterly rebalancing and daily FX hedging. |

|

Equities |

Value |

The strategy invests in 4 favoured sectors by using a CAPE®-based and a momentum indicator, then takes a short position in the S&P 500 (as beta of the 4 favoured sectors). This strategy is developed in partnership with Professor Robert Shiller. |

|

Rates |

Volatility (Defensive) |

Aims to earn the implied vs. realized volatility risk premium present in the USD short-dated swaption market and the carry from the dislocation in the USD long-dated swaption market. |

|

Commodities |

Backwardation + Curve (Carry) |

Aims to generate returns from commodities that are the most in backwardation* (potentially the least in contango) against the benchmark BCOM index. * Backwardation in a commodity occurs when spot is higher than the forward prices and this may be seen as a signal of current commodity scarcity which is generally a positive price driver. |

|

Commodities |

Curve Alpha (Carry) |

Utilizes curve enhancement methodologies to choose a futures curve point that differs from the point selected by BCOM. The strategy also takes a short position in the BCOM index with the aim to extract alpha. |

|

FX |

Value |

Aims to generate returns from G10 currencies whose spot exchange rates have diverged from their fair value (measured using OCED Purchasing Power Parity). The strategy seeks to capture moves when currencies mean-revert to their fair value (examine all 45 crosses within the G10 Currency space) and takes 1-month forward positions on currency pairs every month that are dislocated from their fair value. |

|

FX |

Liquidity |

Aims to take advantage of potential dislocations caused by the systematic currency hedging of investors in US and foreign equities that have historically had a predictable impact on currency markets. The strategy is long or short a 100% gross position to foreign currencies vs. USD, split evenly across British Pound, Australian Dollar, Swiss Franc, Canadian Dollar, Euro, Japanese Yen and New Zealand Dollar. |

|

Multi-Asset |

Trend (Momentum) |

Aims to take positions to capture trends across asset classes excluding Equities to generate absolute returns in both rising and falling markets. The strategy, developed together with Professor Buraschi, from the Imperial College of London, uses advanced trend detection and portfolio construction derived from theoretical and empirical research. |

Index Performance

Important Information

IMPORTANT DISCLOSURES

For important regional disclosures you must read, click on the link relevant to your region. Please contact your Barclays Group representative if you are unable to access.

APAC - https://home.barclays/disclaimers/important-disclosures-asia-pacific/

CONFLICTS OF INTEREST

BARCLAYS IS A FULL SERVICE INVESTMENT BANK. In the normal course of offering investment banking products and services to clients. Barclays Group may act in several capacities (including issuer, market maker, underwriter, distributor, index sponsor, swap counterparty and calculation agent) simultaneously with respect to a product, giving rise to potential conflicts of interest which may impact the performance of a product.

NOT RESEARCH

This website is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research.

BARCLAYS GROUP POSITIONS

Barclays Group, its affiliates and associated personnel may at any time acquire, hold or dispose of long or short positions (including hedging and trading positions) which may impact the performance of a product.

FOR INFORMATION ONLY

THIS WEBSITE IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.

NO OFFER

Barclays Group is not responsible for the use made of this document other than the purpose for which it is intended, except to the extent this would be prohibited by law or regulation.

NO LIABILITY

Barclays Group is not responsible for the use made of this document other than the purpose for which it is intended, except to the extent this would be prohibited by law or regulation.

NO ADVICE

Obtain independent professional advice before investing OR TRANSACTING. Barclays Group is not an advisor and will not provide any advice relating to a product. Before making an investment decision, investors should ensure they have sufficient information to ascertain the legal, financial, tax and regulatory consequences of an investment to enable them to make an informed investment decision. Barclays is acting solely as principal and not in the capacity as a Fiduciary or as a Municipal Advisor.

THIRD PARTY INFORMATION

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services.

PAST & SIMULATED PAST PERFORMANCE

Any past or simulated past performance (including back-testing) contained herein is no indication as to future performance.

INFORMATION SUBJECT TO CHANGE

All information and estimates are given as of the date hereof and are subject to change. Barclays is not obliged to inform investors of any change to such opinions or estimates.